All Categories

Featured

Table of Contents

Why not treat yourself the exact same means? The concept of Infinite Financial works only if you treat your individual bank the exact same method you would certainly a normal bank. You can additionally utilize lendings for among one of the most vital points, which is tax obligations. As a local business owner, you pay a great deal of cash in tax obligations, whether quarterly or each year.

That way, you have the cash to pay tax obligations the following year or the next quarter. If you desire to discover more, have a look at our previous short articles, where we cover what the tax obligation benefits of a whole life insurance policy plan are. Infinite Banking wealth strategy and how you can pay tax obligations via your system

You can conveniently offer money to your company for expenses. You can offer money to your organization for payroll. There are a number of kinds of fundings that you can make to your organization. Afterwards, you can pay that refund to yourself with individual interest. There is no reason not to do that since it's stuff that you would be doing regular monthly anyway.

How do I leverage Self-banking System to grow my wealth?

We utilized our dividend-paying life insurance coverage policy to purchase a building in the Dominican Republic. It's not sufficient to only learn regarding money; we require to comprehend the psychology of money.

Well, we used our entire life the very same way we would certainly if we were to finance it from a financial institution. We had a mid- to low-level credit rating at the time, and the passion price on that cars and truck would be around 8%.

How do I optimize my cash flow with Borrowing Against Cash Value?

Infinite Banking is replicating the standard financial procedure, but you're catching rate of interest and growing money instead of the banks. We end up charging them on a credit score card and making month-to-month settlements back to that card with principal and interest.

Among the very best ways to use Infinite Financial is to pay for your financial debt. Pay yourself back that principal and passion that you're repaying to the financial institution, which is significant. When we first began our financial system, it was because we wished to eliminate our financial debt. Infinite Financial offers you regulate over your financial functions, and after that you actually start to check out the money differently.

Just how several individuals are burdened with student finances? You can pay off your pupil debt and guarantee your youngsters' university tuition thanks to your entire life policy's cash worth.

How does Leverage Life Insurance create financial independence?

That enables you to utilize it for whatever you desire. You can use your car loans for a variety of various points, however in order for Infinite Financial to work, you need to be certain that you follow the three guidelines: Pay on your own first; Pay yourself interest; Regain all the money so it comes back to you.

That's since this point can expand and optimize nevertheless you spend cash. Everyone's way of living is entirely different from the following person's, so what might be practical for us may not be practical for you. Most significantly, you can utilize Infinite Financial to finance your own lifestyle. You can be your own banker with a lifestyle financial approach.

Wealth Building With Infinite Banking

From which life insurance business should I obtain my entire life policy? The only point you ought to maintain in mind is to obtain your entire life insurance coverage plan from one of the shared insurance policy firms.

When you put your money right into financial institutions, for you, that money is just sitting there. It implies the amount you place in grows at a particular rate of interest, however only if you do not utilize it. If you require your money for something, you can access it (under some conditions), yet you will certainly interrupt its development.

What are the risks of using Infinite Banking Benefits?

Simply put, your cash is helping financial institutions make more money. You can't construct wide range with regular banks since they are doing it instead of you. .

This permits you to become your very own banker and have even more control over your money. You can find out the infinite banking advantages and disadvantages to see if this technique is an excellent fit for you and your service. Among the advantages is that you can earn substance interest on the funds in your policy, which can potentially grow at a greater rate than typical interest-bearing accounts.

This is particularly beneficial for local business owner that desire to pass down their service or leave a substantial quantity of riches for future generations. Flexibility and control: As the policy proprietor, you have full control over exactly how you use the money value in your whole life insurance policy plan. You can select when to access the funds, just how much to get, and how to use them.

We will certainly dig into exactly how limitless banking works, its benefits, the procedure of establishing up a policy, the risks and constraints, and choices available (Cash value leveraging). This blog site will provide you with general details to recognize the Infinite Banking Concept (IBC) right here in Canada. Sorry, your internet browser does not sustain ingrained video clips. The Infinite Banking Concept is a monetary strategy that has obtained popularity in current times, particularly in Canada.

How flexible is Infinite Banking For Retirement compared to traditional banking?

The benefit of this technique is that the rate of interest price paid is commonly comparable to what a bank would certainly bill on a similar car loan, is usually tax obligation deductible (when made use of for investment purposes as an example) and the car loan can be paid off at any kind of time without any fine. By borrowing from the plan's cash money worth a person can construct a self-funded source of funding to cover future expenses (ie ending up being one's own banker).

It is important to recognize that boundless financial is not a one-size-fits-all strategy. The efficiency of unlimited banking as a financial savings strategy relies on various factors such as an individual's financial standing and more. Limitless financial is an economic concept that involves using a whole life insurance policy plan as a cost savings and financial investment lorry.

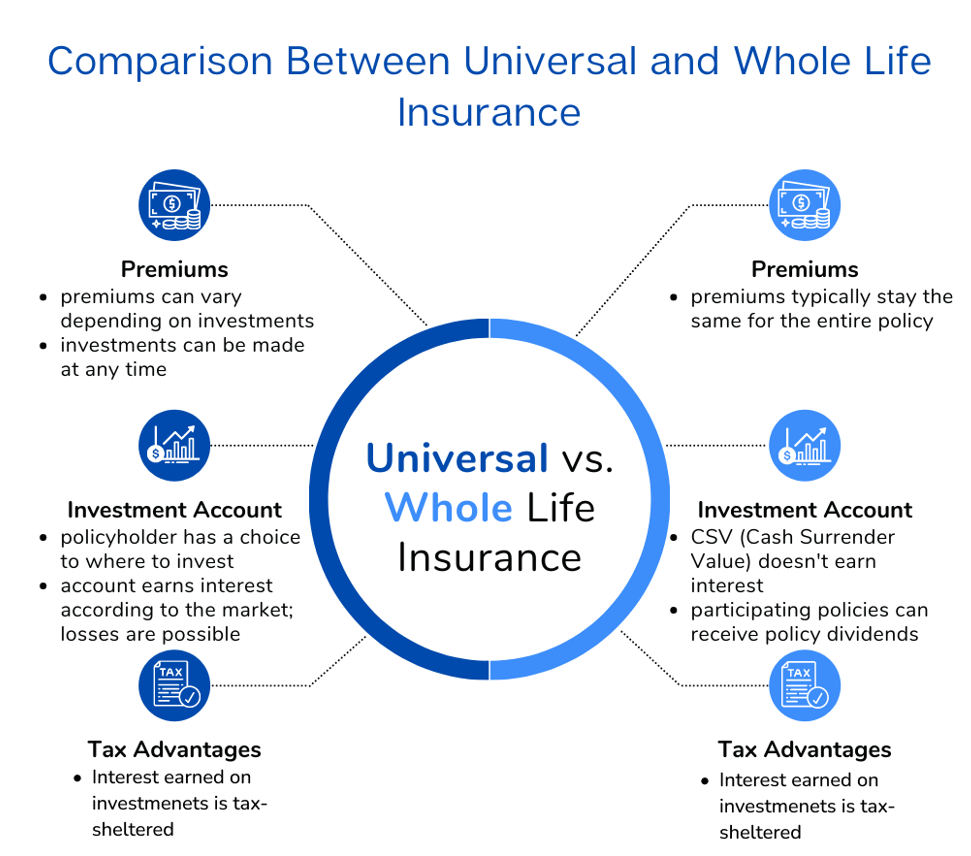

It is crucial to recognize the structure and kind of Whole Life plan made to maximize this strategy. Not all Whole Life plans, also from the very same life insurance policy business are developed the very same. Entire life insurance policy is a sort of long-term life insurance that supplies coverage for the entire life time of the insured individual.

Returns options in the context of life insurance policy refer to how insurance policy holders can choose to use the returns produced by their entire life insurance coverage plans. Which is the oldest life insurance policy business in Canada, has not missed out on a dividend settlement considering that they initially established an entire life plan in the 1830's before Canada was also a nation!

Latest Posts

Understanding The Basics Of Infinite Banking

How To Be Your Own Bank In Just 4 Steps

Infinite Banking Spreadsheets